Mobile Network Operators and the Cloud

I recently had an interesting discussion with a UK-based consultant about the role of mobile network operators (MNOs) in the cloud and how they would deal with the surging mobile traffic. The discussion also related to data centers, network interconnections and proximity of data.

This article is the first of two about our conversation and is a general description of how I see MNOs currently positioned to the cloud. The second article will be somewhat more technically inclined.

Telecoms are late entering the cloud domain

Companies bring different perspectives to cloud computing, depending on their market, location, jurisdiction, and industry. In addition, the “cloud” has a very open meaning and encompasses a variety of configurations, mainly public, private and hybrid clouds.

Generally it has been said that SMEs and startups are more inclined to go for public cloud services (web servers, storage, etc.), while larger companies move more cautiously and either prefer to establish a private cloud environment or a hybrid context. When it comes to software as a service (SaaS), it‘s clear that companies of all sizes are already moving a lot of services into the cloud, including CRM (Salesforce), email and office applications (Office365, Google Apps, etc). I believe this trend will continue. These services and some others that do not entail sensitive data have been successfully delivered cross-borders and continents, without even enterprise customers necessarily knowing the exact location of data or data centers origin.

When it comes to telecoms and data centers or cloud services, I think they are in a unique but fragile situation. Many telecoms already possess large and distributed data centers that have been used for hosting and colocation services for many years. However, compared to cloud services, these have generally been expensive, closed and slow in service provisioning. Most telecoms are late in entering the cloud ecosystem that already offers agility, self-service, pay-as-you-go and other cloud characteristics. However, there is also difference between geographical markets. For example, U.S. telecom providers like Verizon have been very keen on deploying enterprise-class cloud services, especially though their acquisition of Terremark earlier this year.

Telecoms still have some important advantages, especially through existing, and often strong, customer relationship, billing expertise and customer services. All these are important for companies wanting to deploy cloud services in one way or another. Having said this, telecoms, through their existing customer relationship, can offer various bundling of cloud and telecom and/or network services making it still more feasible for customers to retain and expand their business with their telecom service provider. Also, industries that are moving cautiously to the cloud, including financial services and the health-sector, may be more likely to trust their current provider that can guarantee network performance and proximity of data.

When it comes to colocation services in particular, I believe these will gradually be replaced with “remote private cloud” services, like those Amazon and Rackspace are already offering. Companies can obtain a reserved infrastructure and extend their local network into a remote data center that can be accessed through secure and managed networks like MPLS via VPN, IPsec or similar. I am not fully aware how far telecoms have gone in offering remote private cloud services, assuming full web-based self-service and immediate access to infrastructure.

Mobile operators and the cloud

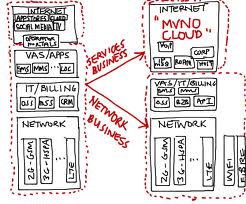

I personally do not think that mobile operators (MNOs) will be particularly strong in running data center based cloud applications and services. Their effort will mostly be gocused on the delivery of cloud service. through the core mobile network and the radio network itself.

However, to provide an improved service delivery, they may select to deploy managed network connections to any of the important cloud providers, but not rely totally upon Internet connections. Another issue is to “fetch” content that is being replicated and made accessible near to the end-user. This is already being done in increased manner through Content Delivery Networks like Akamai and Limelight Networks.

MNOs could possibly develop a strong proposition as cloud brokers, delivering selected cloud services and bundling with others services and billing – similar to telecoms perhaps. Although possible, this is not a straightforward approach, especially since the leading smartphone platform makers (Apple, Google) tend to shape the ecosystem according to their own strategy. MNOs and telecoms are not exactly known for their agility and software prowess, compared to many others.

When it comes to LTE (long term evolution), the mobile network will have the ability to deliver cloud services better and faster with an increased bandwidth capacity of up to 100Mbit/s within each cell – and a pure IP-based traffic all the way to the handset. It should still not be forgotten that the bandwidth is a shared medium, so the service delivery can vary according to the number of users and usage pattern in each cell.

However, as the mobile core and radio network are domains of the MNOs, delivery and service quality can be managed up to a certain degree. Still, latency and congestion will continue to occur, but not necessarily within the mobile network, but perhaps somewhere in the backbone, such as in the Internet.

Backhaul in 4G mobile networks should not necessarily be a limiting factor, as LTE will mostly be restricted to cities and largely populated areas where network capacity and bandwidth are normally in abundance. As for proximity to cloud services, I believe these will increasingly be solved through CDNs as is already happening. Popular content is being replicated or cached to the edges, making it faster to deliver to end-users.

Mobile Network Operators and the Cloud